2020 has been an unpredictable and stressful year after the outbreak of the coronavirus. COVID-19 cases have reached over 10 million worldwide, causing mass shutdowns and further provoking a downturn to the global economy. Many businesses and industries as a whole are suffering and barely staying afloat. For all the drawbacks COVID-19 has brought this year, ESG investing has made a name for itself during this pandemic by doing the complete opposite, progressing.

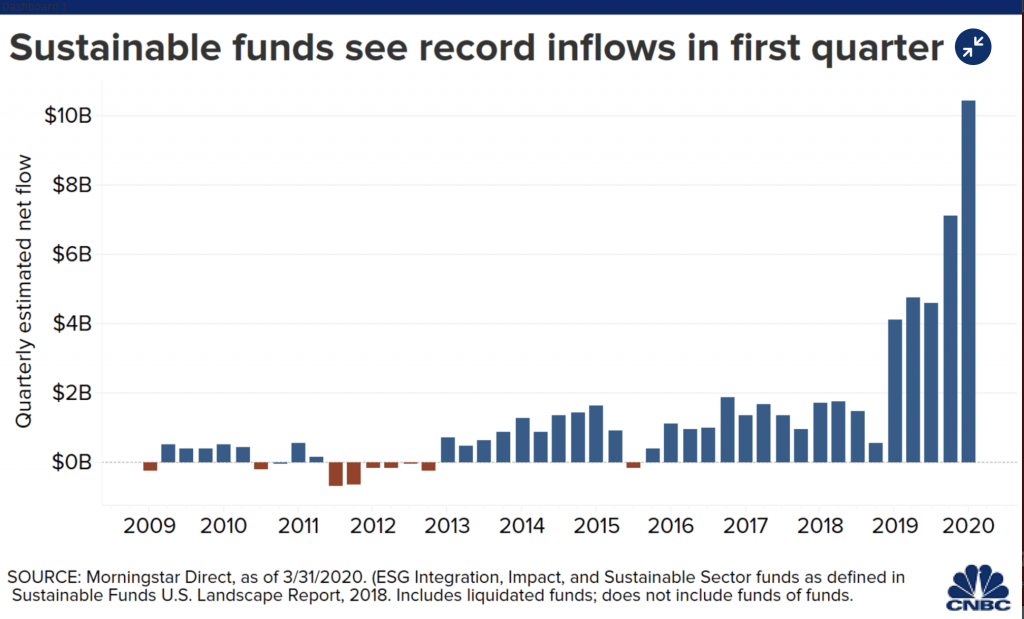

The coronavirus has shifted society in infinite ways, especially when it comes to how people are investing. ESG investing, an approach that focuses on accessing a company’s environmental, social, and governance ratings along with traditional financial metrics, has seen a record amount of inflows in the first quarter of 2020, leaving other non-ESG investing in the dust.

Prior to the pandemic, social aspects to a company were considered to have an uneventful influence on stock prices and corporate reputation. This pandemic has drastically changed this concept since investors are directing their attention more on how well companies are handling the crisis. Some of the aspects individuals are noticing are whether a company is focusing on their employee’s health, locking in job security, and responding to customers’ needs. With more attention to such factors, it has resulted in the growth of ESG investing.

As said by Jean-Xavier Hecker and Hugo Dubourg, Co-Heads of ESG and Sustainability within J.P. Morgan EMEA Equity Research,

“We believe that pandemics and environmental risks are viewed as similar in terms of impact, representing an important wake-up call for decision-makers. The impacts of the COVID-19 crisis on the real economy and the financial system highlight the limits of most forecasting models, which do not deal well with non-linear, complex systemic risks” (Stevens).

Stevens, Pippa. Sustainable Investing Is Set to Surge in the Wake of the Coronavirus Pandemic. 7 June 2020, www.cnbc.com/2020/06/07/sustainable-investing-is-set-to-surge-in-the-wake-of-the-coronavirus-pandemic.html.

Jon Hale, Morningstar’s director of sustainability research, said that this kind of investing, ESG, is being put to the test by going through an unexpected recession. As time passes, ESG investing continues to reach new numbers and attracting new customers. Even though responsible investing has existed for years now, ESG funds have been able to fully bloom and shoot up these past five years without being affected by the dwindling decline the market is facing. (Stevens).

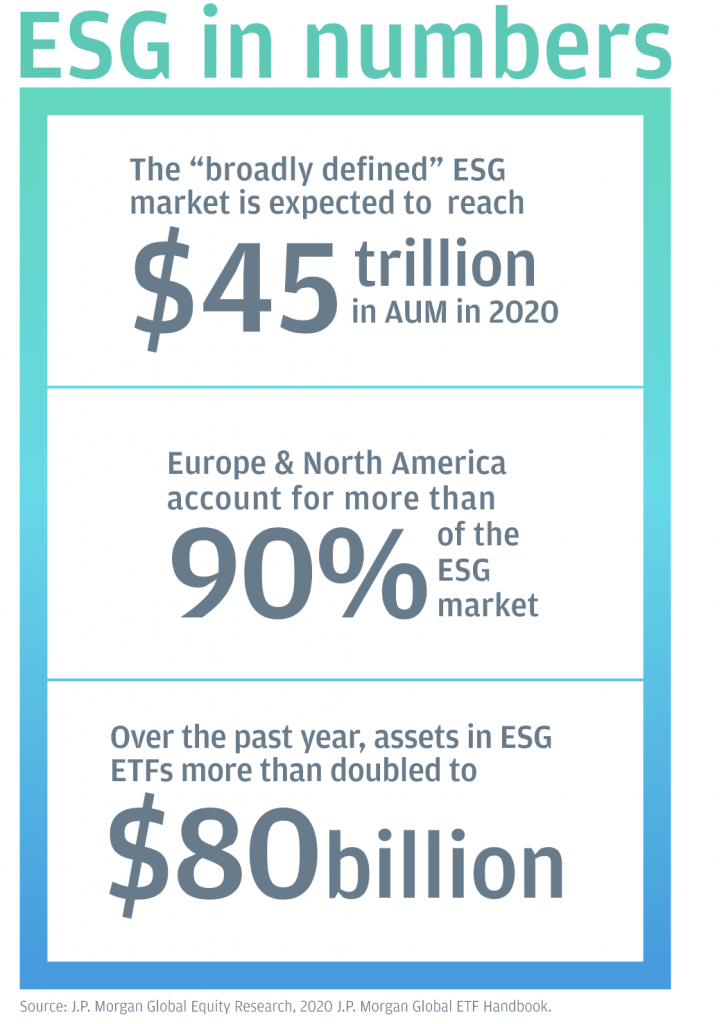

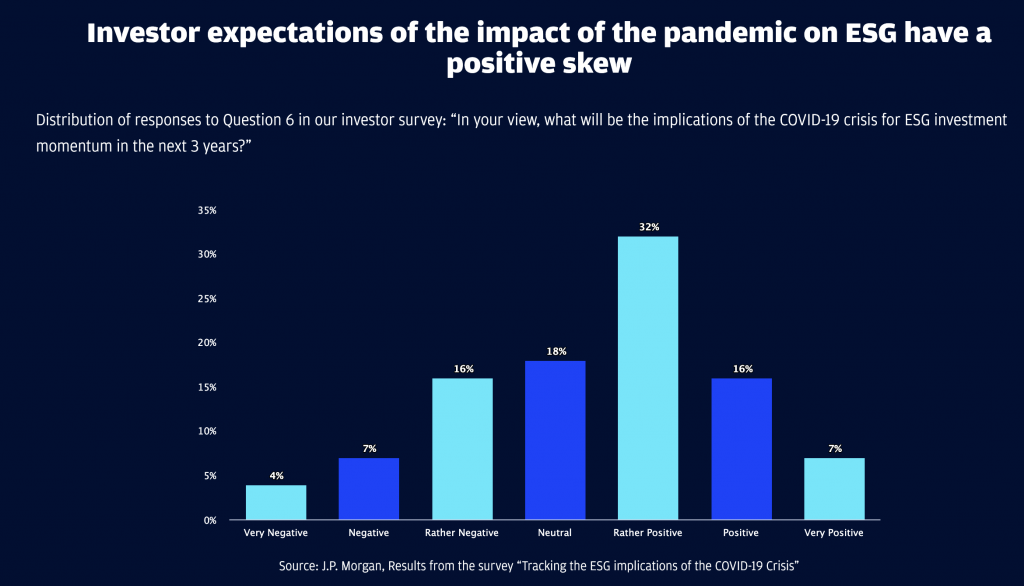

Sustainable investing inflow is likely to continue to grow during this non-stop pandemic, which in turn will curate more conversation about this hot trend. J.P. Morgan believes that sustainability risks are likely going to continue to flourish long after the coronavirus crisis passes. In their survey below, it exhibited that the majority (55%) had an optimistic outlook on how much ESG would expand in the following 3 years. 27% of the respondents believe ESG investing will slow down, and 18% believe it will be stagnant.

“The positive skew of expectations contrasts with the intuition that times of crisis shift the focus towards short-term economic and financial issues. Yet, it is important to note that the question specifically mentioned a time horizon of three years. Investors, therefore, are likely to differentiate between a potentially negative impact in the next few weeks/ months and a positive impact in the longer run.” stated Hecker and Dubourg.

Stevens, Pippa. Sustainable Investing Is Set to Surge in the Wake of the Coronavirus Pandemic. 7 June 2020, www.cnbc.com/2020/06/07/sustainable-investing-is-set-to-surge-in-the-wake-of-the-coronavirus-pandemic.html.

Whether investors want to hop on the movement of ESG investing, there is no denying the growth potential it holds.